Speculation Tax

The new “speculation tax” will amount to 0.5% for Canadian citizens and permanent residents. 2.0% of the property’s assessed value for foreign owners, satellite families, and other non citizens or PR..

Which group will be most likely affect by Speculation Tax?

British Columbia’s new property tax targeting out-of-province owners will hit British Columbians, Albertans and other Canadians who have vacation and recreational use homes there with a big additional bill of thousands of dollars.

On Tuesday, one of the primary measures in the B.C. budget was the introduction of what the government is calling a speculation tax. It is aimed at foreign and domestic property owners who are parking capital in real estate and driving up prices in the province. It would apply to owners who do not pay income tax in British Columbia. Principal residences are exempt, as are properties with long-term renters.

A typical vacation home that is used several times a year but is otherwise empty would not be exempt. “If you are from outside the province and you leave your home vacant, you will be taxed,” B.C. Finance Minister Carole James told reporters on Wednesday.

Foreign Buyer Tax

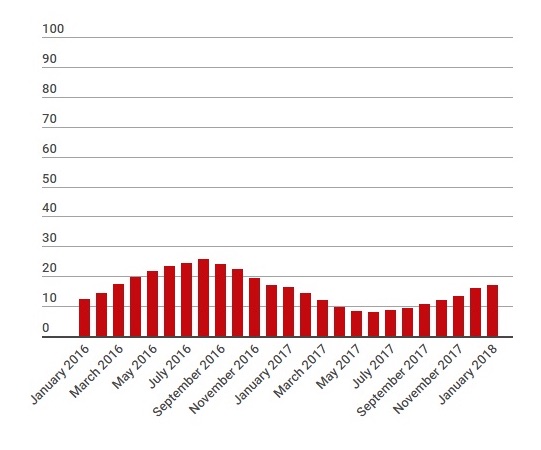

Metro Vancouver has had a 15 per cent tax on foreign home purchasers since 2016. The province announced Tuesday it would hike the levy to 20 per cent and impose it in the Victoria and Nanaimo areas, as well as the Fraser Valley and central Okanagan.

Foreign transactions made up 1.8 per cent of purchases in the central Okanagan, 1.4 per cent in the Fraser Valley, 4.3 per cent in the Victoria area and 4.4 per cent in the Nanaimo area, provincial data compiled by the B.C. Real Estate Association shows.

Prices in the many outside Vancouver regions have steadily risen due to population growth and declining inventory, not foreign buyers. People from Vancouver are moving to the region to escape high housing costs and enjoy a more relaxed lifestyle.

As for the increased rate of the foreign buyer’s tax, which will extend beyond Vancouver to include the Fraser Valley, Nanaimo, the Central Okanagan and the Capital Region District.

“For some foreign buyers it is just the cost of doing business, but some will likely move capital to other locations such as Ontario. And I think that can open the door to the government in Ontario to raise its taxes.”

Though he believes the base of foreign buyers in Canada’s market is small and the new taxes introduced in B.C. will have limited impact among their ranks, the measures will likely go some distance to discourage domestic speculation. “Foreign buyers are just such a small part of the marketplace that there’s really no difference on the affordability side.”

Will Metro Vancouver Real Estate market drop in a significant amount because of all the new tax and regulations?

The median value of Vancouver homes jumped to 11 times the median household income in 2016, up from a ratio of 9.4 times in 2011, data compiled by Yan show. By comparison, the ratio for Toronto rose to 8.3 in 2016 and was 4.9 for Canada, which is skewed higher by the two cities, while 3 or less is considered affordable.

While Vancouver’s empty home tax and restrictions on home-sharing services like Airbnb have helped slow detached home sales, demand for less-expensive condos has become frenzied, prompting some experts to question whether any new policy will be effective.

“It’s about balancing supply and demand without killing the golden goose,” said Andy Yan, director of The City Program at Simon Fraser University, noting British Columbia’s finances are dependant on the booming real estate sector, and efforts to cool Vancouver’s hot market could hurt less frothy cities.

The Urban Development Institute, which represents developers, has warned the NDP against imposing too many demand curbs, pushing instead for incentives for purpose-built rental units and less red tape to promote more multi-family construction.

BCREA said the new tax measures, which came into effect on February 21, 2018, are unlikely to stabilize the housing market. The new tax measures introduced by the government to “stabilize the housing market” are unlikely to achieve the intended objective. The taxes ignore the major culprit in matching housing supply and demand within a reasonable timeframe. Additional taxes, whether targeted at foreign buyers or speculators, do not reduce the gap between when a housing project starts, and when it is available to purchase.

For Real Estate needs or need help to list your home please call.

Call 604.723.3699

Source:

http://thelinkpaper.ca/?p=67514

https://globalnews.ca/news/4037313/bc-budget-housing-taxes-prices/

One Comment

Comments are closed.